Why the Market’s Rollercoaster Feels Different After Your Clients Retire

Sequence-of-Returns Risk: The Silent Threat to Their Retirement Income

The Risk Most Clients Don’t See Coming

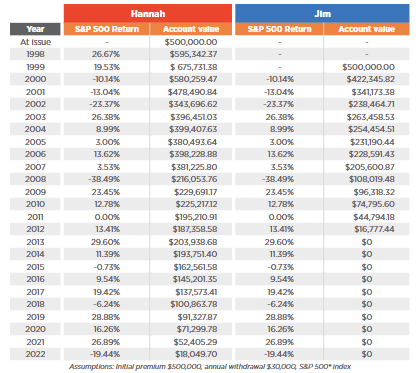

Two retirees start with the same portfolio. Both average 6% returns over 30 years. One enjoys steady income all the way through. The other runs out of money a decade too soon.

Same investments. Same withdrawals. Same average return. Different outcome.

That’s sequence-of-returns risk, and it’s one of the most important, and least understood, threats to a client’s retirement success.

Explaining Sequence-of-Returns Risk Simply

Here’s the client-friendly way to explain it:

During the accumulation phase (when they’re working and saving), bad market years can actually help. They’re buying more shares at lower prices.

During the distribution phase (when they’re retired and withdrawing), those same bad years can devastate the plan. They’re forced to sell shares at a loss, which locks in damage and leaves less to recover when markets rebound.

Use analogies that stick, like starting a marathon too fast and burning out early. Same distance, same runner, but the order of events changes everything.

Why It Matters More in 2025

Longer retirements: 30+ years of income isn’t unusual anymore.

Market volatility: Inflation, rates, and geopolitical shocks are creating uncertain first-decade returns.

Clients’ expectations: Today’s retiree is hyper-aware of risk but still wants upside.

This is where advisors add enormous value, by helping clients avoid turning a bear market into a lifestyle crisis.

How to Help Clients Manage the Risk

You can’t control the markets, but you can help clients control how much of their essential spending is exposed to them.

Cover Essentials with Guaranteed Income

Start with a conversation about what expenses they absolutely cannot reduce: housing, healthcare, food, insurance premiums. Then layer their guaranteed income sources:

Social Security: Their base layer of inflation-adjusted income.

Pensions: Include any employer-sponsored plans or defined-benefit payouts.

Lifetime Income from Annuities: For whatever gap remains, products like fixed index annuities, deferred income annuities, or SPIAs can create a personal “retirement paycheck.”

Once those essentials are covered, clients can leave the rest of their portfolio invested and avoid panic-selling during down markets, effectively neutralizing sequence-of-returns risk for their core needs.

📥 Free Client Resource: Download Our Sequence-of-Returns Explainer (PDF)

Use this handout to walk clients through the concept. It shows, side by side, how two identical retirees can end up with dramatically different outcomes based solely on the order of market returns. It’s one of the clearest ways to start the “income floor” conversation.

Deliver Confidence, Not Just Performance

Helping clients see beyond account balances to reliable, sustainable income is one of the most powerful ways to differentiate yourself. You’re not just managing investments — you’re managing outcomes.

Run an Essential-Needs Income Gap Analysis for your top clients. Identify what portion of their retirement spending is already covered by guaranteed sources, and where adding a lifetime income solution could create peace of mind, and reduce the risk of portfolio depletion in a bear market.